Price of Copper probably a bullish Development for the Stock market

Many pundits associate higher copper prices with inflation. This is the wrong metric to look at; higher copper prices are usually associated with an improving economy.

Copper has traded past a key resistance point ($3.00) and it has managed to close above this important level on a monthly basis. The long term outlook for copper is now bullish and will remain so as long as it does not close below 2.80 on a monthly basis. Copper is facing resistance in the 3.20-3.25 ranges and as it is now trading in the extremely overbought ranges. As copper is now trading in the extremely overbought ranges, it is more likely to let out some steam before trading past this zone. A healthy consolidation will provide copper with the force necessary to challenge the 3.20 ranges and trade as high as $3.80 with a possible overshoot to $4.00, provided it does not close below $2.80 on a monthly basis.

Now that copper has traded past $3.00 on a monthly basis, the Fed deserves another pat on the back for they have managed to further cement the illusion that this economic recovery is real. Copper is seen as a barometer for economic growth, so pulling off a Houdini here is probably going propel a lot of former naysayers to embrace this economic recovery.

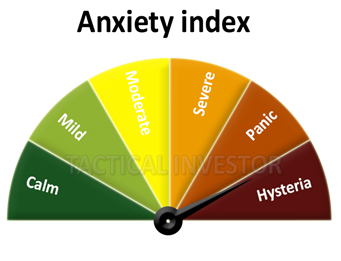

Mass Sentiment is still Negative so Stock Market likely to Correct only

Combining this data with the action in the Copper markets leads us to believe that the stock market is more likely to experience a correction than an outright crash. Higher copper prices are usually indicative of higher stock market prices. Therefore, the copper markets are confirming that the long term trend is still intact.

What about the Inflation issue?

The chart below puts an end to that argument for now. If inflation were an issue, the velocity of M2 money stock would be trending upwards. Until it starts to trend upwards, inflation is not an issue and the focus should be on higher stock market prices.

Conclusion

Don’t focus on the noise; focus on the trend as it’s your friend and everything else is your foe.

Published courtesy of the Tactical Investor